Invoices

In accordance with the Terms and Conditions of the sterim.eu online store

§ 6 Placing an Order, conclusion of the Sales Agreement, payments and Order processing, points 15 and 16:

[...]

15. Consumers who wish to receive a VAT invoice are required to inform the Seller of this before placing an Order.

16. The Customer agrees to receive invoices from the Seller electronically to the email address provided by the Customer. If the Customer wishes to receive a VAT invoice in paper form, they are required to clearly inform the Seller of this before placing the Order. VAT invoices are sent to the address or email address provided by the Customer in their Account or when placing an Order. In the case of a Customer who is not a Consumer, their data for issuing a VAT invoice is collected by the Seller from the Central Statistical Office (GUS).

Invoice details

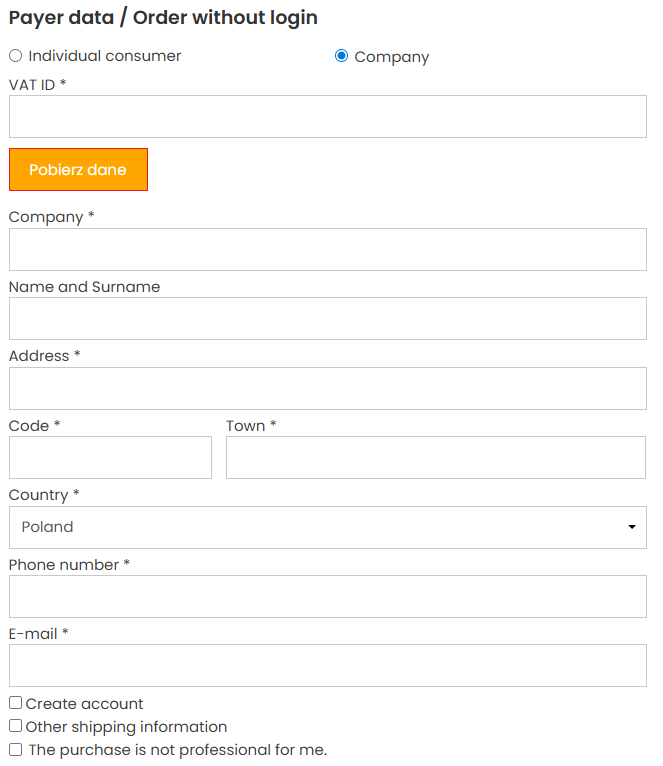

Invoice details are obtained from the form completed by the user during the order process and are previously retrieved from the Polish Central Statistical Office (GUS).

If additional data are entered in the "First and last name" field, these data will also be included on the document. Providing an e-mail address and a contact phone number is mandatory.

IMPORTANT – if personal data of the ordering person should not appear in the "Buyer" field on the invoice, please leave the "First and last name" field empty.

Editing the invoice after it has been issued is no longer possible.

![]() Enter the VAT number, company name and address. Check "I have EU VAT number" if applicable.

Enter the VAT number, company name and address. Check "I have EU VAT number" if applicable. ![]() Complete the missing fields – contact phone number and e-mail address are mandatory

Complete the missing fields – contact phone number and e-mail address are mandatory

Invoice issue date

Invoices are issued within 7 days from the moment the payment is credited to the account and are sent to the e-mail address provided in the order.

Questions about invoices? Contact us!

Sterim Sp. z o.o.,

ul. Winogrady 118,

61-626 Poznań

VAT ID: 9721314466

REGON: 388122320